Money Saving

If you find a broken link in this list, please report it to the webmaster.

Two questions before you start

1. Do you have any debts?

If you do, it's far better to pay off debts before starting to save. The interest on your debts is much higher than the interest earned on savings. So pay off your debts with your savings and you're much better off.

In some circumstances, this can apply to your mortgage as well as credit card debts too. For more info on this, please read the full Repay Debts or Save? guide first.

2. Do you want to save or invest?

It's important to understand the difference between saving and investing as a start point.

Saving - You put money away in complete safety, and get it all back plus interest.

Investing - You risk losing some interest and/or some cash for the chance it'll grow quicker.

There is no right answer here - it all depends on your circumstances. Over the long term, investing usually outperforms savings. Unfortunately, as investing comes with a risk, this isn't guaranteed. Get it wrong, or even just get the timing wrong, and you could end up with less than you started with.

Of course, investing is not just the stock market. Property, wines, antiques, and starting a business can all be seen as types of investment. They all involve you putting money away in the hope your assets will appreciate, but with the risk you may lose cash.

If you can't afford or don't want to take any risk with your cash, then saving is for you and thus read on. If you want to invest, see ourShare dealing and Stocks and Shares ISA guides.

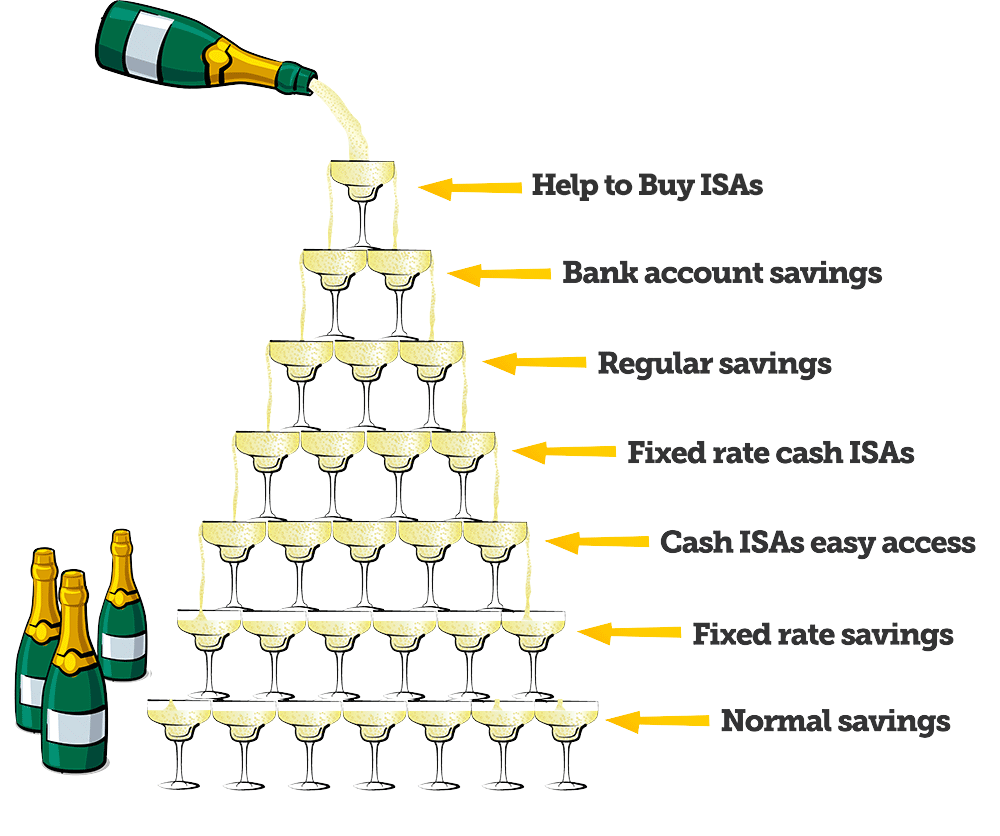

The Savings Fountain

Different types of savings have different rules on how much you can put in and when. To max your interest, you need to pour money where it'll pay best.

Think of it like a champagne fountain - put your cash into the best-paying savings vehicle possible, then when that's full and overflowing, fill up the next best, and so on.

1.- Help to Buy ISAs

This is only the first stage of the savings fountain for first-time buyers; if you're not a first-time buyer skip straight to step 2.

The Help to Buy ISA was launched in December 2015; for anyone 16+ who's never owned a home and may want to, this is usually a no-brainer - not because of the interest, but because if you use it towards a mortgage deposit the state adds 25% on top, up to a max £3,000.

The technical definition of a first-time buyer is someone who has not "had an interest" in a residential property in the past, whether it's bought or inherited

For a full breakdown of all the best Help to Buy ISAs, read the Help to Buy ISAs guide.

2.- Bank accounts

Bizarrely, some bank accounts' in-credit rates currently smash easy access savings accounts and ISAs - especially now all interest is paid to you tax free. It's a loss leader to build banking customers - yet if you're prepared to switch account, rates are strong. Don't just focus on rate, aim to cover as much as possible at decent rates.

If you're not eligible for a Help to Buy ISA, max the best bank accounts before you move onto any of the other options. If you're eligible for the Help to Buy ISA, fill that first, then move onto bank accounts before the other options below.

For a full breakdown of all the best bank accounts, read the Best Bank Accounts guide.

3.- Regular savings

Once you've filled your current account(s), start to trickle your money into regular savings. A regular savings account can pay high interest but it's only on a small amount of money.

While these accounts can pay slightly more than bank accounts, as you need to put cash in each month, you'd want to dripfeed it across from your bank account/top savings account anyway - hence why it's third.

For a full breakdown of all the best regular saving accounts, read the Full Regular Savings guide.

4.- Fixed-rate cash ISAs

Once you've maxed your regular savings account, move any money you don't need access to into an ISA.

A cash ISA is just a savings account where the interest isn't taxed (so you keep all of it). Anyone over the age of 16 in the UK can put up to £15,240 in an ISA each tax year (April 6 - April 5) and once in, it stays tax-free year after year.

Better still, with fixed-rate cash ISAs, unlike normal savings, you can get access to the cash within the term - though you'll lose some interest in penalties. Yet even if you withdraw early, these can still be winners.

For a full breakdown of the best fixed-rate cash ISAs, read the Fixed-Rate cash ISA guide.

5.- Easy-access cash ISAs

If you know you'll need access to your cash then you'll need to go for an easy access ISA. Here there's no withdrawal restrictions, you can get your cash when you want it.

Don't forget if you've got old ISAs built up over the years you can transfer them into a better paying ISA. But NEVER just withdraw the cash and pay it in. Full help inISA Transfers.

For a full breakdown of the best easy access cash ISAs, read the Easy Access cash ISA guide.

6.- Fixed-rate savings

If you've still got money left, next consider whether you're prepared to lock it away without access - if so, you can fix with a locked in rate that's usually higher.

Do bear in mind if rates rise over the term you can't switch, so think carefully before fixing for longer than a couple of years. .

For a full breakdown of the best fixed-rate savings accounts, read theFixed-Rate Savings guide.

7.- Easy-access savings

With whatever you've got left, anything you need access to stick it in an easy access savings account. Rates are lowest compared to everything else in the fountain, but you can deposit and withdraw cash at your leisure.

All the easy access savings deals have a variable rate, so you need to monitor them to ensure the rate doesn't drop (switch away if it does).

For a full breakdown of the best easy access saving accounts, read theEasy Access Savings guide.

Get Martin's Free Money Tips Email!

For all the latest deals, guides and loopholes - join the 10m who get it. Don't miss out

10 quick savings tips

Before you rush off to pour cash in the fountain, here are a few key tips...

1. You don't pay tax on savings interest IF you're a basic-rate taxpayer and earn under £1,000 interest

From 6 April 2016 the new personal savings allowance means every basic-rate taxpayer can now earn £1,000 interest without paying tax on it, equivalent to the interest on almost £75,000 in the top easy-access savings account. Higher-rate taxpayers can earn £500 interest before paying tax, but additional-rate taxpayers don't get an allowance.

This means that savings interest will be tax-free for 95% of taxpayers. Plus, interest earned on ISA cash doesn't count towards this allowance - so say you earn £500 interest on ISA cash and you're a basic-rate taxpayer, you'll still have your full £1,000 personal savings allowance to cover other interest.

Earn more in savings interest than your allowance and you'll pay tax at your normal rate on the amout that exceeds it (so 20% for basic-rate and 40% for higher-rate). For full details, see the Personal Savings Allowance guide.

2. Cash ISAs may still be worth it for some

Even though there's no tax gain, and the new personal savings allowance means unless you earn a substantial amount in interest you won't pay tax on it anyway, ISAs often pay higher rates than equivalent savings, cash ISA fixes have more access, and if you become a taxpayer again, the cash is protected then.

Plus, if you do have a lot in savings, and you do become a taxpayer again, your ISA interest won't count towards your personal savings allowance so you'll keep more of your interest from other accounts. Read Martin's Is the Cash ISA dead? for why it's still a decent option.

3. Put savings in name of lower-rate taxpayer

If one of you pays tax at a higher rate, providing you trust each other, put non-ISA savings in the name of the lower taxpayer and you'll take home more, as the lower taxpayer gets a higher personal savings allowance. For those who aren't married/civil partners, there is a tiny risk if one of you died within seven years of this that there'd be inheritance tax on it.